The FCA and the PRA have both published their Consultation Papers on Diversity and Inclusion in the Financial Sector. The FCA’s Consultation closes on 18th December 2023 with a Policy Statement expected in 2024, and implementation 12 months after that.

In its Consultation document, the FCA sets out what it is trying to achieve. The FCA considers that greater diversity and more inclusion can improve outcomes for consumers and markets by diversifying thinking, supporting healthy work cultures, unlocking diverse talent and improving understanding of and provision for diverse consumer needs.

In its Consultation, the FCA sets out proposals to better integrate non-financial misconduct considerations into:

- staff fitness and propriety assessments

- Conduct Rules

- the suitability criteria for firms to operate in the financial sector (the Threshold Conditions)

The FCA also proposes to require certain firms to:

- report their average number of employees to us on an annual basis

- collect, report and disclose certain D&I data

- establish, implement and maintain a D&I strategy

- determine and set appropriate diversity targets

- recognise a lack of D&I as a non-financial risk

Fortunately, the FCA recognises the need to be proportionate in this area and firms with less than 251 employees would be exempt from many of the requirements, especially parts of the new proposed regulatory return. This figure matches existing Gender Pay Gap reporting requirements. There are also exemptions for limited scope SM&CR firms.

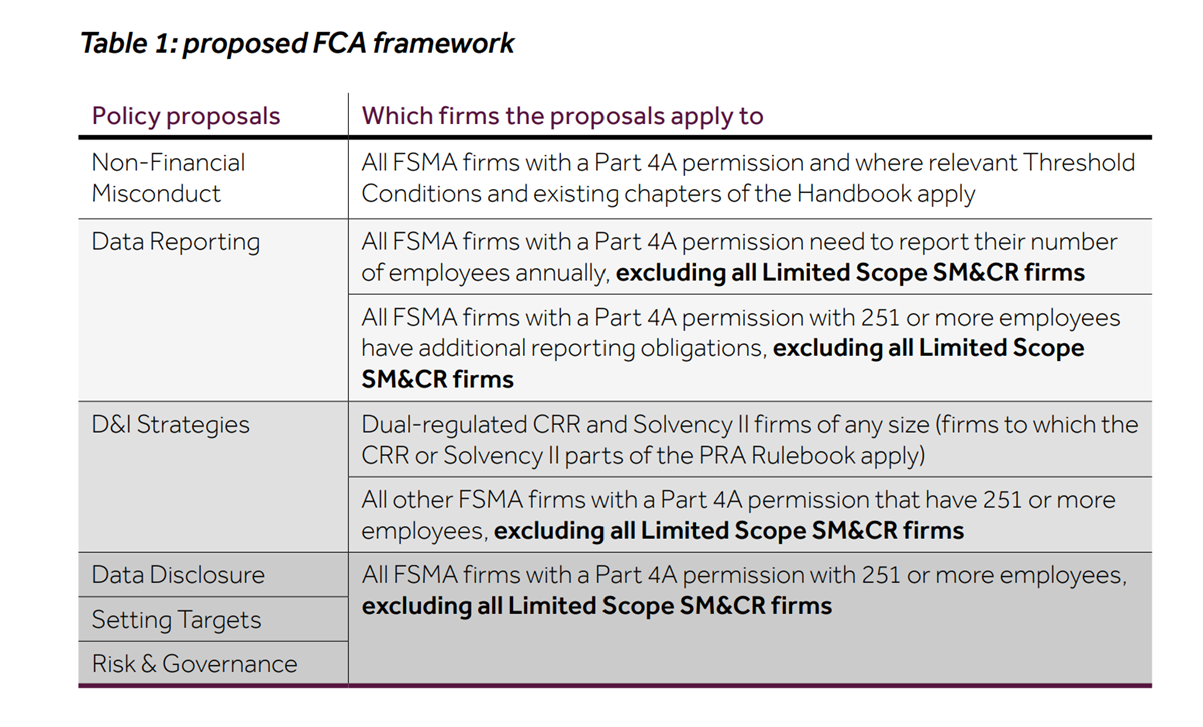

The table below, an extract from the Consultation Paper, sets out the various reporting requirements, and the types of firms captured.

Within the draft proposed Handbook text, the FCA has included significant extra detail in the COCON, COND and FIT sections of the Handbook on what constitutes non-financial misconduct, and examples thereof. This is likely to be driven by a recent high-profile non-financial misconduct case and the FCA’s dealings with the Treasury Select Committee in this regard.

Some additional considerations, which are unclear from the Consultation, are set out below.

- In some Groups, staff are employed by a group services company; in that case, how would a firm determine its number of employees, especially where they work for a number of group companies? The FCA is clear (para 3.23 in the Consultation) that “Our proposals apply on a solo entity basis, to ensure progress is made at an individual firm level.” This may require further clarification.

- Does a Principal firm have to include its Appointed Representatives in terms of aggregation of staff numbers and applying the rules? The Consultation seems to be silent on this.

- It may be a challenge for the FCA to prove a firm is breaching Threshold Conditions because of failings in this area. D&I is probably one area where it is easier for the FCA to pursue an individual (under FIT and COCON rules) rather than the firm (under COND rules).

- Although this is only at the Consultation Paper stage, firms may wish to consider the proposed new guidance on non-financial misconduct now, especially where they are wrestling with any current disciplinary cases, and debating whether they should be included on the forthcoming REP008 Conduct Rules Breaches form or not. This is due by the end of October, for the year ended 31 August 2023. Firms in this situation may wish to take legal or employment law advice.

Independently, the law firm Browne Jacobson and the University of Nottingham (with support from BIBA) have recently published a detailed report on “Transforming Equality, Diversity and Inclusion in UK Insurance” following a survey that they undertook. Unfortunately, this provides evidence of why the FCA may need to act in this area.