The FCA has published the 2022/23 periodic regulatory fees and levies for the FCA, FOS, the Money and Pensions Service (referred to in the FEES manual as the Single Financial Guidance Body – SFGB), devolved authorities, and the Treasury’s expenses in funding the teams that tackle illegal money lending. The Policy Statement also includes the FCA’s feedback on the responses to the consultation on the draft fees and levies rules in CP22/07 ‘FCA Regulated fees and levies: Rates proposals 2022/23’.

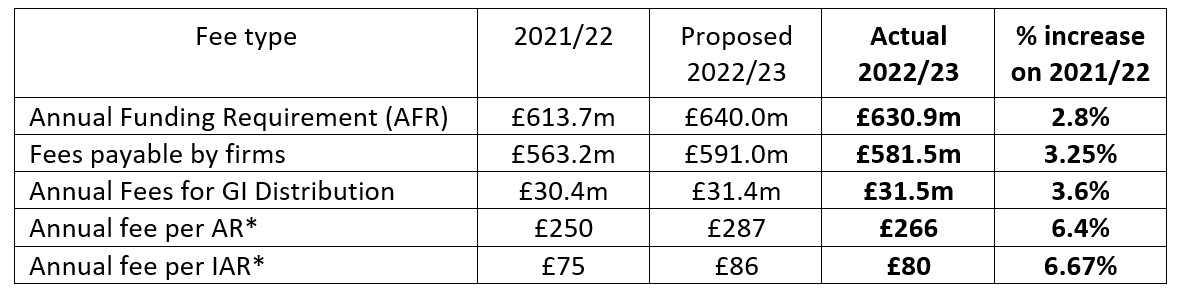

Since consulting, the FCA has made some changes that have had the effect of lowering the proposed overall fee increases, but there are still fee increases which are summarised below:

*The AR and IAR annual fee increases have been brought into line with the rate of inflation in February 2022. The FCA is reviewing its long-term funding arrangements for developing policy towards ARs and ongoing regulation and enforcement, where the FCA expects to intensify activity in line with its published business plan and strategy. It will review the options for cost recovery in the fees policy Consultation Paper that it expects to publish in November.

Although the AFR and the total fees payable have reduced, the proposed fees to be paid by the GI distribution sector have increased fractionally – so this sector is suffering a higher fee increase than the increase in the AFR and the increase in fees payable in total (so 3.6% against 2.8% and 3.25% respectively).

- Taking into account feedback from smaller firms, in particular, the FCA is phasing the increase in minimum fees over four years instead of three. Information in this regard is available in Tables 2.3 and 2.4 on page 13 of the Policy Statement.

- The FCA will invoice fee-payers from July 2022 onwards for their 2022/23 periodic fees and levies and will return to the standard invoice payment term of 30 days (so removing the extended payment terms concession that has been in place).

- Following the introduction of the new FCA authorisation and application fees structure in March this year, the FCA intends to uprate the charges each year in line with the ORA budget to avoid the fees falling behind in the future. The FCA will be consulting on the first uprating in April 2023, to come into effect from 1st July 2023.

Firms can use our online fees calculator to calculate their individual fees based on the final rates in this Policy Statement. This includes FCA periodic fees and the Financial Ombudsman Service, Money and Pensions Advice Service, Devolved Authorities and illegal money lending levy final rates. The fees calculator will also cover PRA fees and FSCS levies.